Highlights from Market Share Report: 1Q13 FTTx, DSL, and CMTS

2013-07-02

Every quarter Ovum provides a detailed market share report on the FTTx, DSL and CMTS equipment markets. This report is based on detailed data collected from more than 20 vendors. This article covers revenue and unit shipments.

In a nutshell

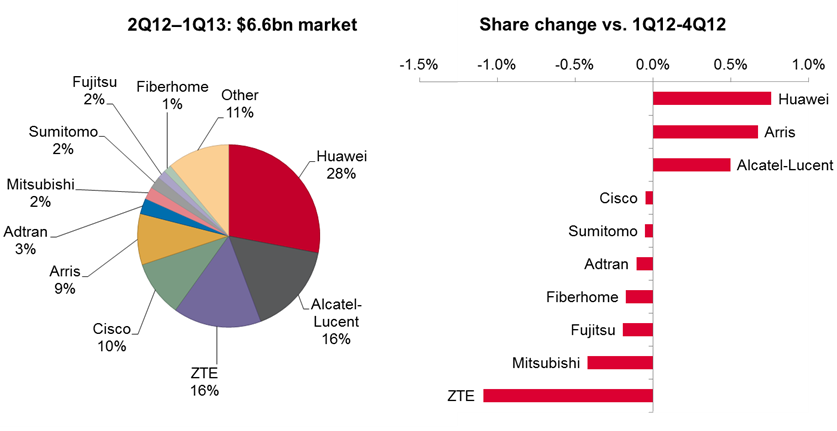

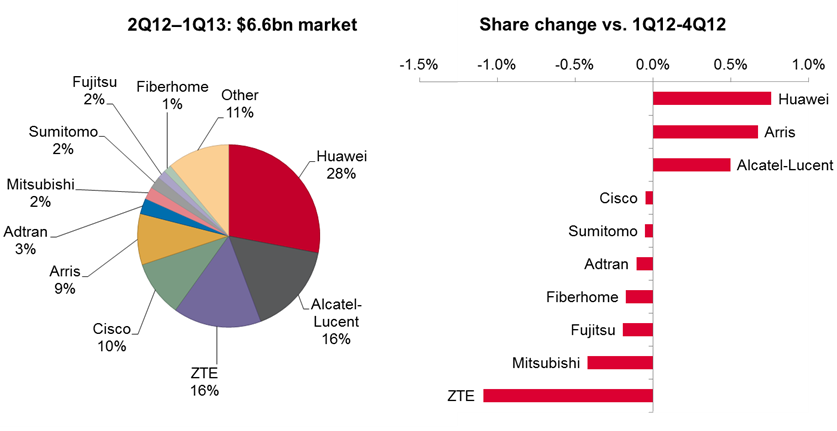

Fixed access equipment revenues continued to fall in 1Q13, totaling $1.3bn compared to $1.7bn for 4Q12 and $1.8bn for 1Q12. The impact of declining DSL and PON OLT port shipments was not offset by slight increases in CMTS and PON ONT shipments, and lower average selling prices (ASPs) for DSL and PON devices also suppressed revenues. Among the top 10 vendors on a rolling 4-quarter basis, Huawei, Arris, and Alcatel-Lucent gained market share, while ZTE and Mitsubishi lost the most share, as shown in Figure 1. We expect fixed access equipment revenue declines to persist throughout 2013. FTTx network builds are maturing in Japan and Korea and are expanding more evenly in China, thereby limiting OLT shipment growth. Steep ADSL shipment declines are not being offset by increases in VDSL volumes. ONT shipments will remain strong as subscribers are brought onto FTTx networks, particularly in China, but pricing pressure will continue to drive down total PON sales. CMTS shipments remain strong, but on an annual basis revenues are declining. On a positive note, 10G EPON equipment is being shipped by several vendors for deployments in China.

Figure 1: Combined FTTx, DSL, and CMTS revenue market share and changes for top 10

Source: Ovum

Ovum view

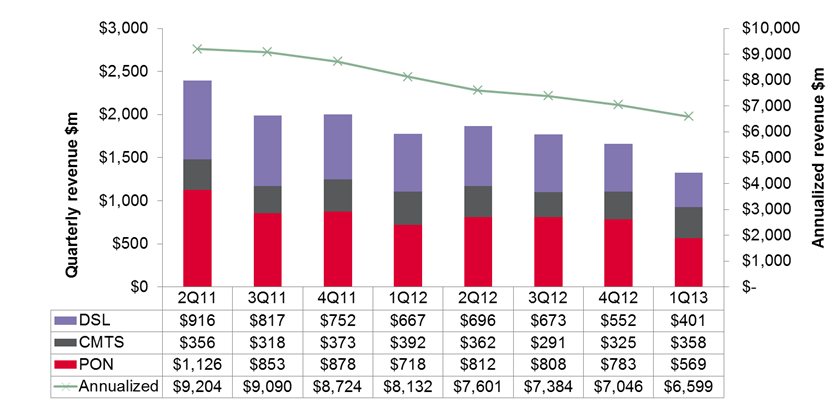

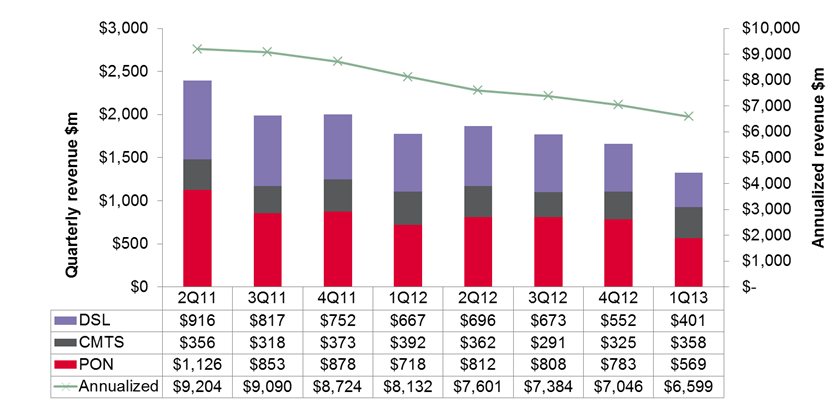

Annualized combined revenues continue to decline (Figure 2). PON revenues fell 27% sequentially and were down 21% from the year before. DSL revenues declined 27% sequentially and a whopping 40% YoY. CMTS revenues for 1Q13 were up 10% sequentially but down 9% YoY. PON continues to be the largest segment. The downward trend of annualized FTTx, DSL, and CMTS revenues is likely to continue throughout the year based on macroeconomic conditions in Western Europe, FTTx deployment cycles in Asia-Pacific, and falling ASPs in the PON and DSL markets.

Figure 2: Global FTTx, DSL, and CMTS revenues by quarter, 2Q11–1Q13 plus annualized

Source: Ovum

Both OLT port shipments and OLT revenues declined. OLT revenues declined 36% sequentially and 28% YoY due to declining shipments and significantly lower ASPs. Total OLT port shipments declined by 8% sequentially and by 11% YoY.

Within the OLT market, GPON continued to gain on EPON. GPON OLT port revenues represented 74% of total OLT revenues in1Q13. GPON OLT port shipments grew to 68% of total OLT shipments in 1Q13 from 50% the year before. By segment, on a rolling 4-quarter basis, GPON OLT ports reached 2.4 million in 1Q13, compared to 2.2 million for the previous rolling 4Q period, and EPON shipments declined to 1.6 million from 1.9 million.

ONT/ONU revenues declined 23% sequentially and 18% YoY even though shipments increased sequentially and YoY. ONT shipments increased 3% sequentially and 44% YoY as subscribers are being brought onto FTTx networks. However, the shipment increases were not sufficient to offset falling ASPs.

Next-gen PON shipments are increasing, but quantities remain low. 10G EPON is shipping in China and shipments are likely to increase, but we do not expect to see significant shipments of 10G PON in the near future.

Within PON, Huawei gained market share while Mitsubishi lost market share. Huawei, ZTE, and Alcatel-Lucent combined continue to represent more than 70% of PON revenues and 82% of PON equipment shipments.

PON revenues will continue to decline unless major FTTx deployments begin in highly populated countries and/or PON is deployed in larger quantities for non-FTTx applications such as mobile backhaul.

DSL revenues declined 27% sequentially and 40% YoY. ADSL revenues continue to fall rapidly – in 1Q13 they dropped 45% sequentially and were down 68% YoY. VDSL revenues declined 11% sequentially but grew 25% YoY. We expect VDSL shipments to remain strong in several regions, but VDSL revenues will not offset the decline in ADSL revenues.

Alcatel-Lucent gained the most share in the DSL market while ZTE lost the most share. The market remains highly concentrated, with Huawei, ZTE, and Alcatel-Lucent combined representing close to 80% of total DSL revenues and shipments.

CMTS revenues increased 10% sequentially but declined 9% YoY. Arris gained slightly on market share while Cisco lost slightly.

Recommendations for PON component and equipment vendors

PON component and equipment vendors will continue to face declining revenues unless new, major FTTx deployments occur in highly populated countries and/or PON usage is extended to non-FTTH applications, such as mobile backhaul.

PON component and equipment vendors can influence the usage of PON for mobile backhaul. First, many PON component and equipment vendors have added features, such as time-of-day synchronization, to support mobile backhaul. Next, PON component and equipment vendors need to focus on market education for service providers. Most wireless service providers are not familiar with PON and its ability to support mobile backhaul. Even among wireline service providers, PON is not well known outside of residential broadband access groups.

PON can enable fixed–mobile convergence with the FTTx network, supporting mobile backhaul for macro cells and small cells, along with broadband access for homes, businesses, and smart cities. Several communications service providers are using PON for mobile backhaul, but details are not widely known.

Market education encompasses the usual activities, such as presentations, white papers, articles, webinars, and seminars. The audience needs to include both wireline and wireless network planning and operations teams.

FTTX RESULTS

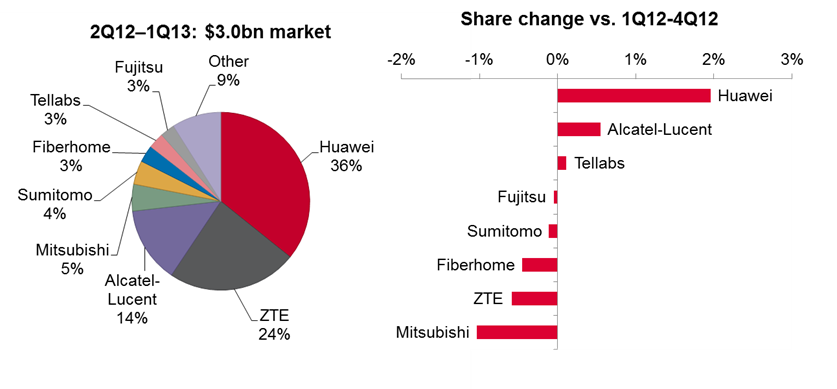

FTTx PON revenues continue to decline for most vendors

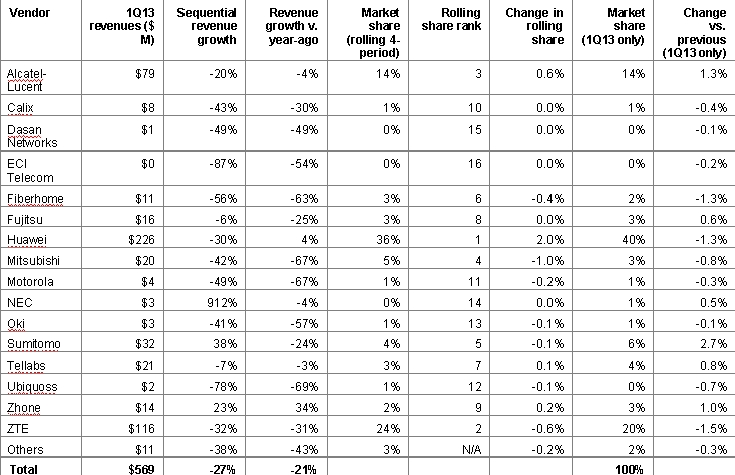

PON revenues for 1Q13 declined 27% sequentially and were down 21% YoY.as shown in Table 1. Most vendors reported declining revenues both sequentially and from the year-ago quarter. A few exceptions are worth noting. Zhone’s revenues increased both sequentially and YoY. Zhone commented on an exceptionally strong 1Q13 due to shipments for a customer in the Middle East. Sumitomo’s 1Q13 revenues increased sequentially, possibly due to PON shipments supporting FTTx network deployments in Indonesia. Huawei’s 1Q13 revenues improved versus the year-earlier quarter; Huawei had backed away from some low-margin PON business in 2012.

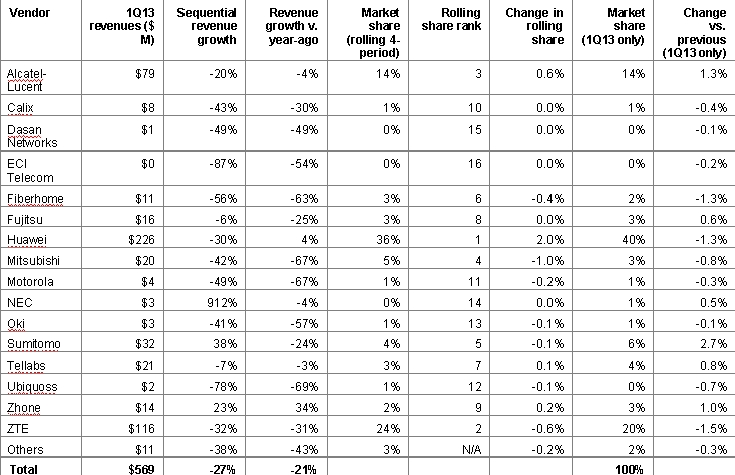

Table 1: Analysis of global FTTx PON quarterly revenue results, 1Q1

FTTX MARKET SHARE CHANGES

Minor shifts in FTTx PON market share

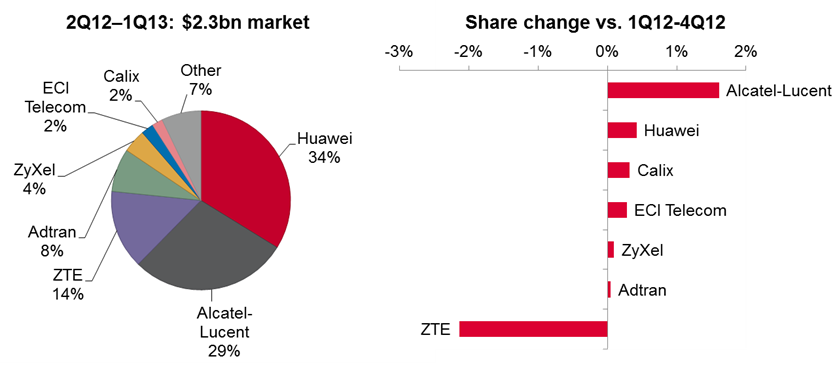

Figure 3 shows rolling 4Q market share along with changes in market share. Huawei, ZTE, and Alcatel-Lucent continue their domination of the PON market; they are the only vendors with double-digit market share.

Huawei and Alcatel-Lucent both gained market share (2.0% and 0.6% respectively) while ZTE lost 0.6% market share. These changes reflect the decline in EPON OLT port shipments, where ZTE had held top position in terms of revenues and shipments for the past several years.

Fiberhome’s market share also declined, by 0.4%, and is struggling against gains by Huawei and Alcatel-Lucent. Other market share losers include Mitsubishi, Sumitomo, and Fujitsu, reflecting maturing FTTx networks in Japan. While Sumitomo has begun to sell FTTx PON gear outside of Japan, it will take several strong quarters to impact its market share on a rolling 4-quarter basis.

Figure 3: FTTx PON revenue market share and changes for top eight vendors

Source: Ovum

1Q13 FTTX PON SHIPMENTS

PON OLT shipments continue to decline; Huawei gains share

PON OLT port shipments declined 8% sequentially and were down 11% YoY as shown in Table 2. Huawei gained 4.0% in market share on a rolling 4Q basis while ZTE lost 3.5%

We heard that China Telecom has not yet announced winners for its 2013 PON equipment tenders; shipments are continuing under previous contracts. However, the delay in China Telecom’s tenders may negatively impact OLT port shipments for the full year.

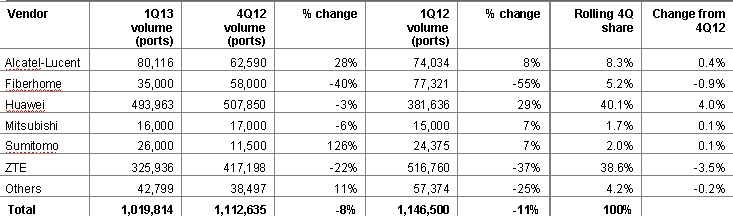

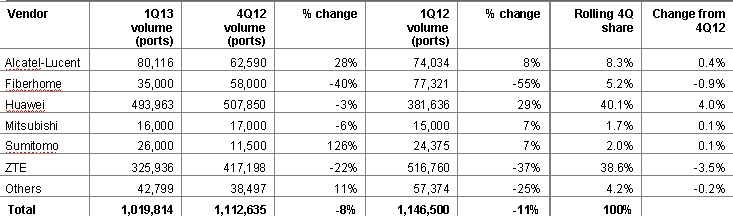

Table 2: Analysis of FTTx PON OLT port shipments and market share for top six

Source: Ovum

PON ONT/ONU shipments are growing, with Huawei gaining share

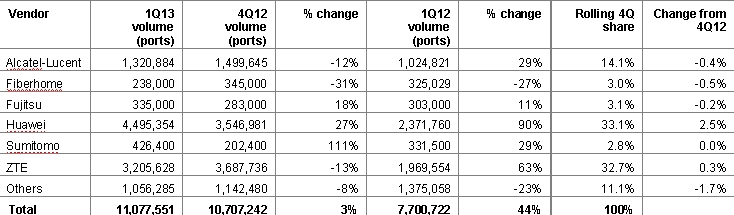

1Q13 PON ONT/ONU shipments increased 3% sequentially and were up 44% from the year-ago quarter. On a rolling 4-quarter basis, Huawei gained 2.5% market share as shown in Table 3.

ONT/ONU shipments are expected to remain strong throughout 2013 as subscribers are brought onto FTTx networks.

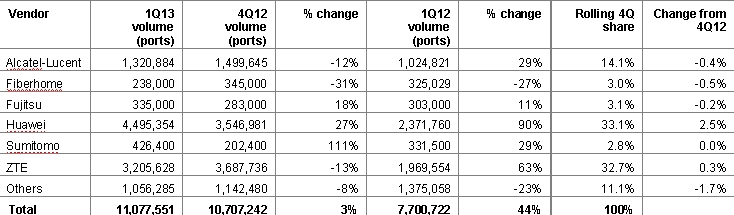

Table 3: Analysis of FTTx PON ONT/ONU shipments and market share for top six

Source: Ovum

1Q13 DSL RESULTS

Total DSL revenues decline sharply due to ADSL deterioration

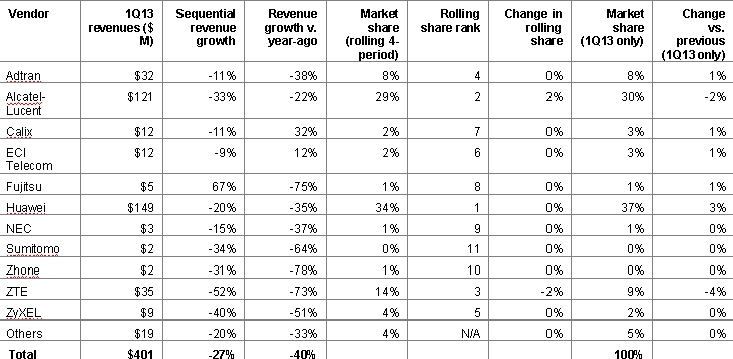

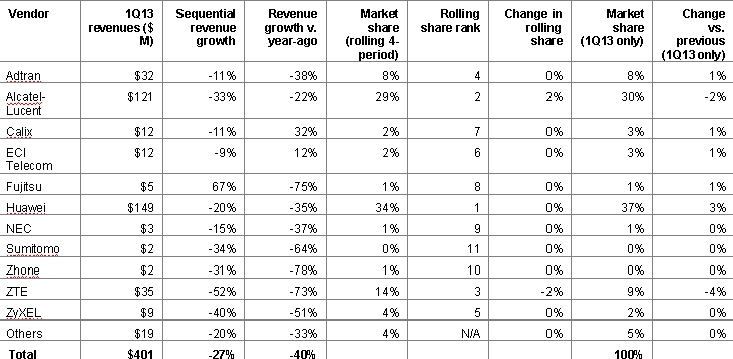

Table 4 shows the revenue results for DSL vendors. Overall, DSL revenues in 1Q13 declined 27% sequentially and were down 40% from the year-ago quarter. Every vendor but eighth-ranked Fujitsu suffered sequential revenue declines. The two largest vendors, Huawei and Alcatel-Lucent, saw significant sequential drops in revenue (20% and 33% respectively) and declines of 35% and 22% respectively from the year-ago quarter. On a rolling 4-quarter basis, Huawei and Alcatel-Lucent together garnered 62% market share; with ZTE, combined market share amounted to 77%.

Increases in worldwide VDSL shipments were not sufficient to offset the large drop in worldwide ADSL shipments. Asia-Pacific is largely responsible for the drop-off in ADSL shipments as China forges ahead with FTTx network deployments.

Table 4: Analysis of global DSL quarterly revenue results, 1Q13

Source: Ovum

DSL MARKET SHARE CHANGES

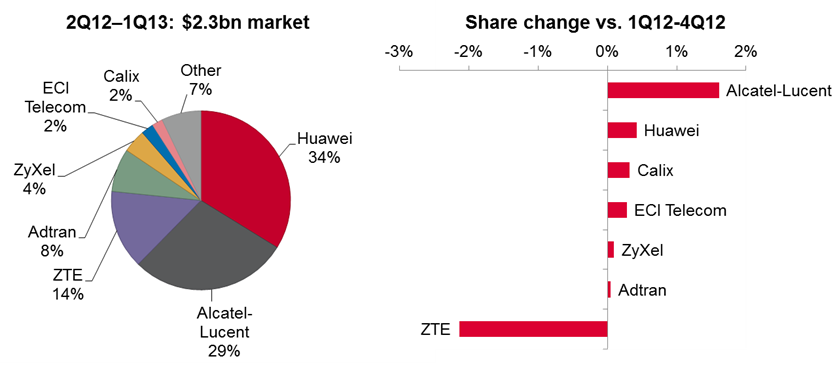

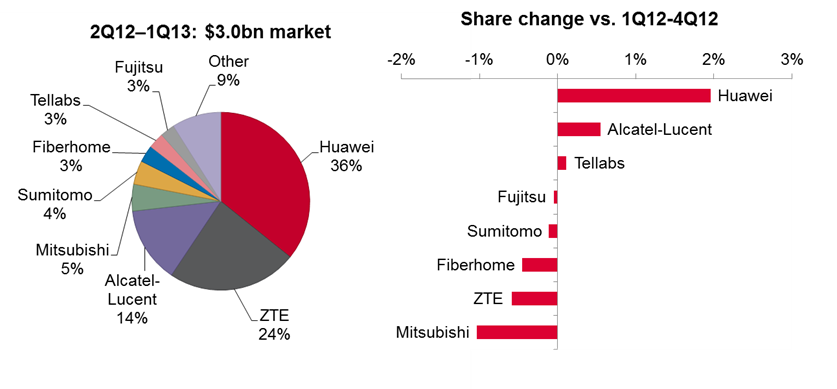

Alcatel-Lucent claims the largest gain while ZTE shows the largest loss

As per Figure 4, Huawei remained #1 in the DSL market with a 34% share of revenues, followed by Alcatel-Lucent with 29%. Alcatel-Lucent gained 1.6% in market share on a rolling 4-quarter basis while ZTE lost 2.1%.

Figure 4: DSL revenue market share and changes for top seven vendors

Source: Ovum

1Q13 DSL SHIPMENTS

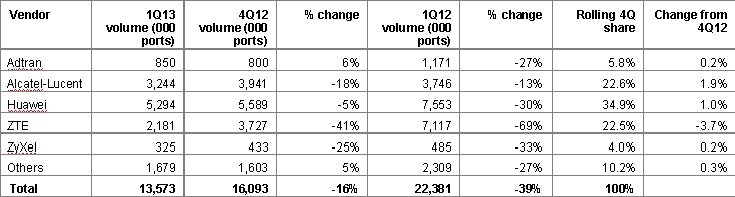

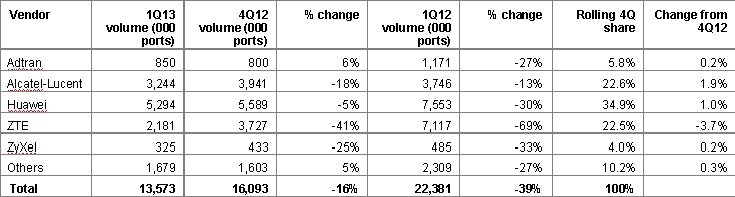

Total DSL shipments decline significantly due to ADSL drop-off

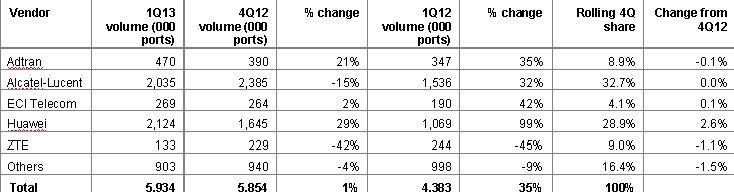

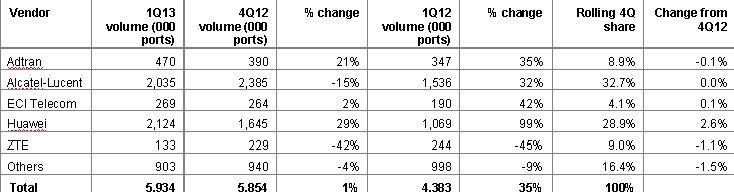

Mirroring declines in DSL revenues, DSL shipments fell 16% sequentially and were down 39% from the year-earlier quarter as shown in Table 5. In 1Q13 VDSL shipments increased by 1% sequentially and were up 35% YoY as shown in Table 6. The VDSL gains were not sufficient to offset the drop in ADSL shipments.

Table 5: Analysis of DSL shipments and market share for top five

Source: Ovum

Table 6: Analysis of VDSL shipments and market share for top five

Source: Ovum

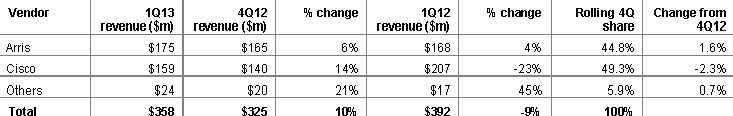

1Q13 CMTS RESULTS

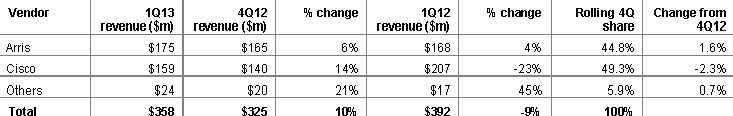

Revenues grow sequentially; Arris moves ahead of Cisco

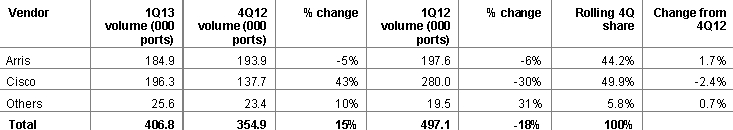

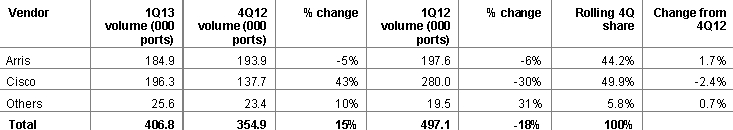

Table 7 provides analysis of quarterly results for the two major CMTS equipment vendors. Arris moved ahead of Cisco for the quarter, reflecting its acquisition of Motorola Home. Both Arris and Cisco posted growth on a sequential basis, but Cisco’s sales were down from the year-ago quarter.

Table 7: Analysis of global CMTS quarterly revenue results, 1Q13

Source: Ovum

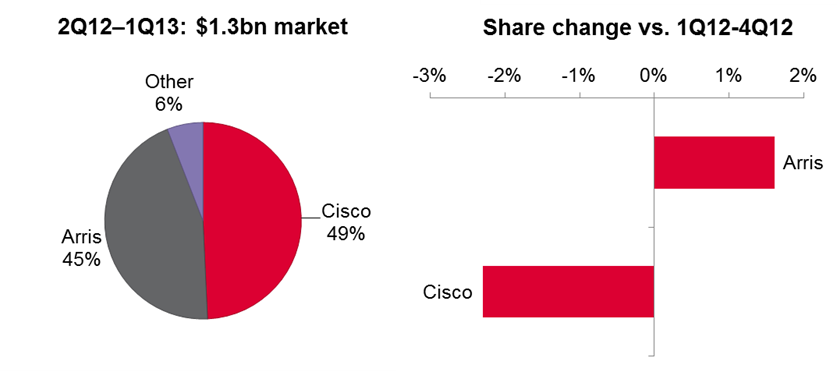

CMTS MARKET SHARE CHANGES

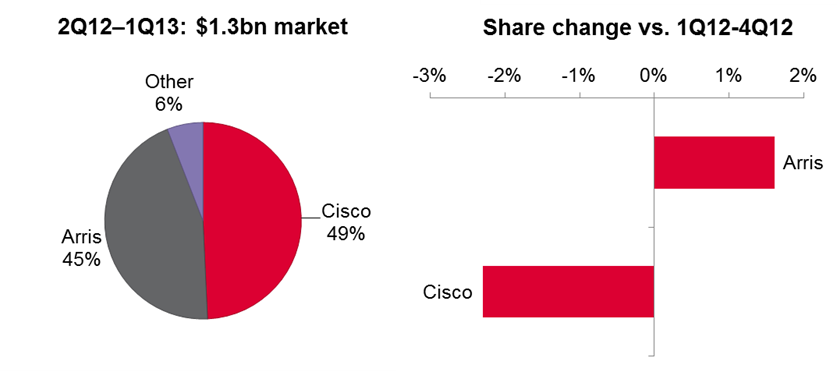

Arris gains but Cisco leads

As shown in Figure 5, Arris gained 1.6% market share on a rolling 4-quarter basis while Cisco lost 2.3%. This change in market share is due primarily to Arris’s acquisition of Motorola Home’s CMTS business.

Figure 5: CMTS revenue market share and change for Cisco and Arris

Source: Ovum

1Q13 CMTS SHIPMENTS

Uneven results on volumes

Based on shipments, Cisco’s CMTS volumes improved 43% on a sequential basis while Arris’s declined 5%. Both Arris and Cisco posted a decline from the year-earlier quarter, with Cisco’s shipments down 30%.

Cisco adjusted its CMTS shipments upward for previous quarters back to 1Q09 but did not adjust revenues. Ovum’s spreadsheets, along with tables and figures, have been updated to reflect Cisco’s restatements.

Table 8: Analysis of CMTS shipments and market share for Cisco and Arris

Source: Ovum

PRODUCT-LEVEL ANALYSIS – FTTX PON

All PON technology types show sequential revenue declines

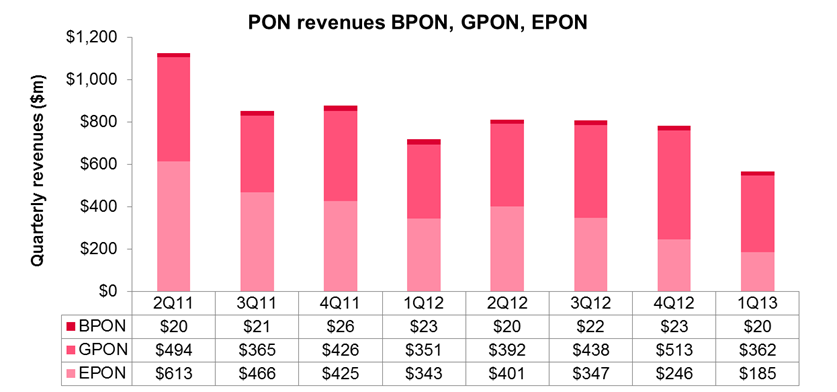

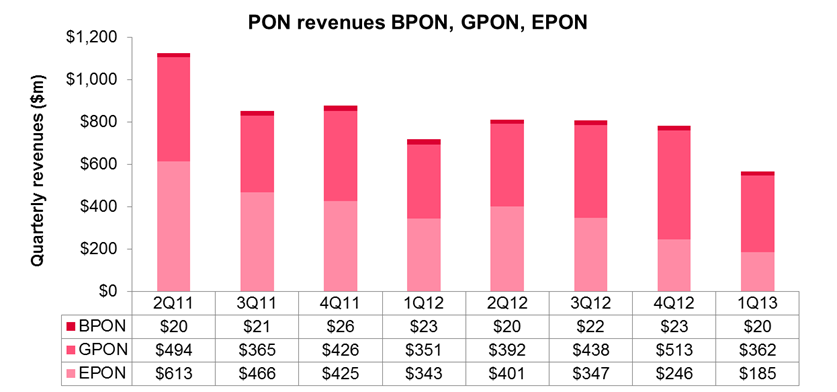

Figure 6: Quarterly revenues split by FTTx PON technology, 1Q12–1Q13

Source: Ovum

Figure 6 shows quarterly revenues split by FTTx PON technology. On a YoY basis, EPON revenues declined by 46% while GPON revenues grew slightly by 3%. The large YoY decline in EPON is due to maturing EPON FTTx network builds.

All PON technology segments suffered sequential revenue declines in 1Q13, with EPON down 25% and GPON down 29%. We believe that these steep sequential drops were largely due to delays in China Telecom’s 2013 tender announcements along with declining ASPs.

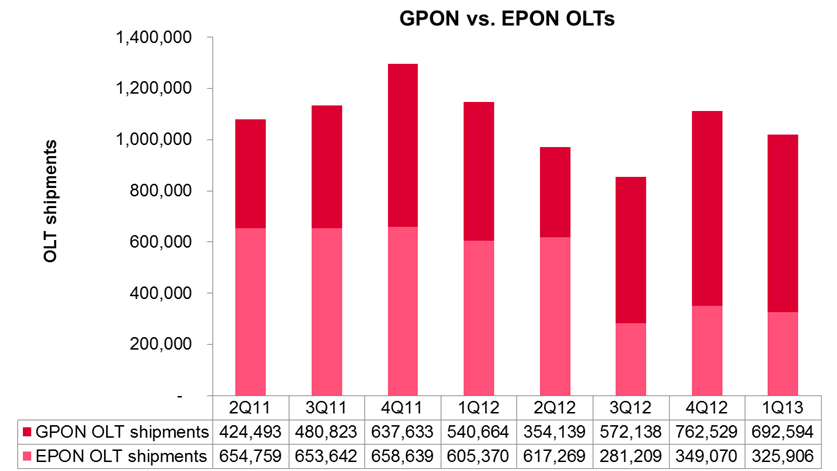

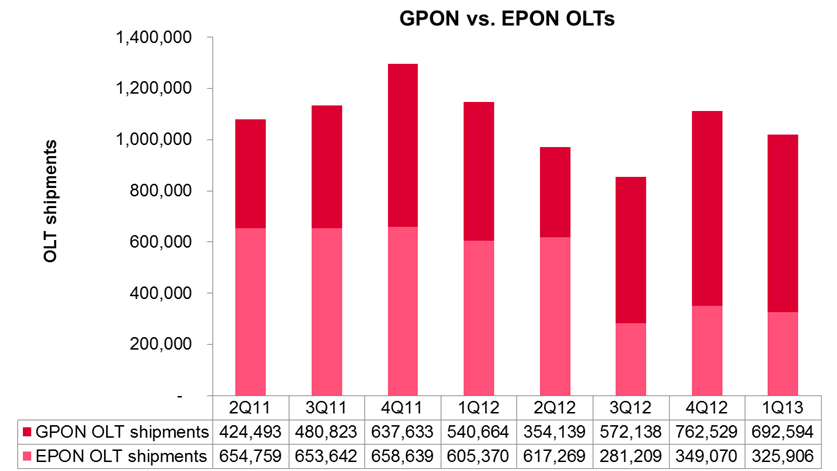

Figure 7 displays OLT port shipments by type. GPON OLT port shipments declined 9% sequentially but were up 28% from the year-ago quarter. These changes were expected given new GPON FTTx network deployments in China and other countries, such as Malaysia and Indonesia.

Figure 7: FTTx OLT port shipments, GPON vs. EPON, 2Q11–1Q13

Source: Ovum

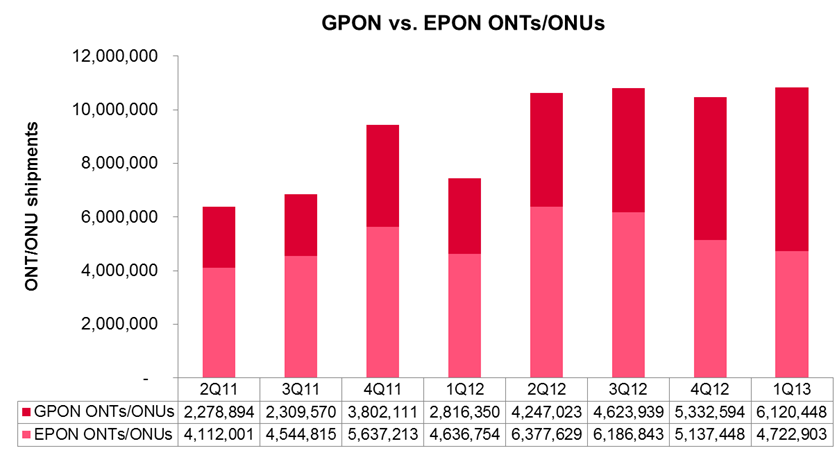

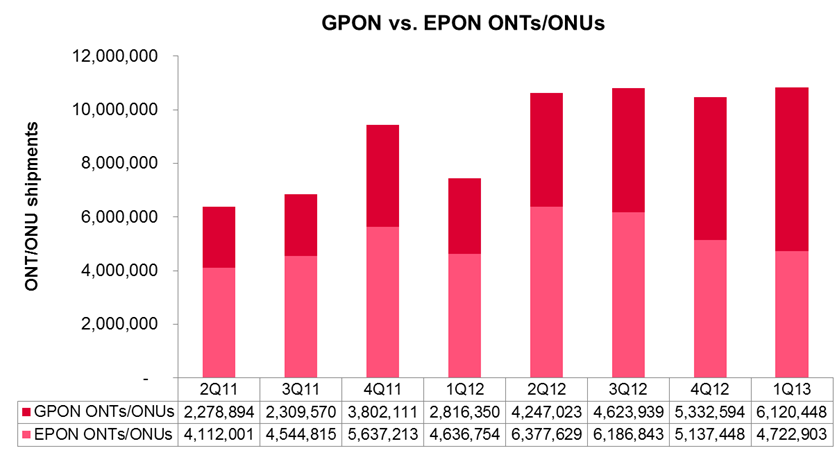

Figure 8 displays PON ONT/ONU shipments by type. GPON ONT/ONU shipments grew by 15% sequentially and were up a whopping 117% from last year. EPON ONT/ONU shipments declined by 8% sequentially but were up 2% YoY.

EPON ONT/ONU shipments will persist as subscribers are brought onto EPON-based FTTx networks, but we expect further sequential declines.

We expect GPON ONT/ONU shipments to grow over the next several years primarily due to China’s GPON-based FTTx deployments, along with smaller deployments in other countries.

Figure 8: FTTx ONT/ONU shipments, GPON vs. EPON, 2Q11–1Q13

Source: Ovum

By:Julie Kunstler Source:c114